Secrets to Successful Insurance Claims Revealed! (Coverage)

Introduction

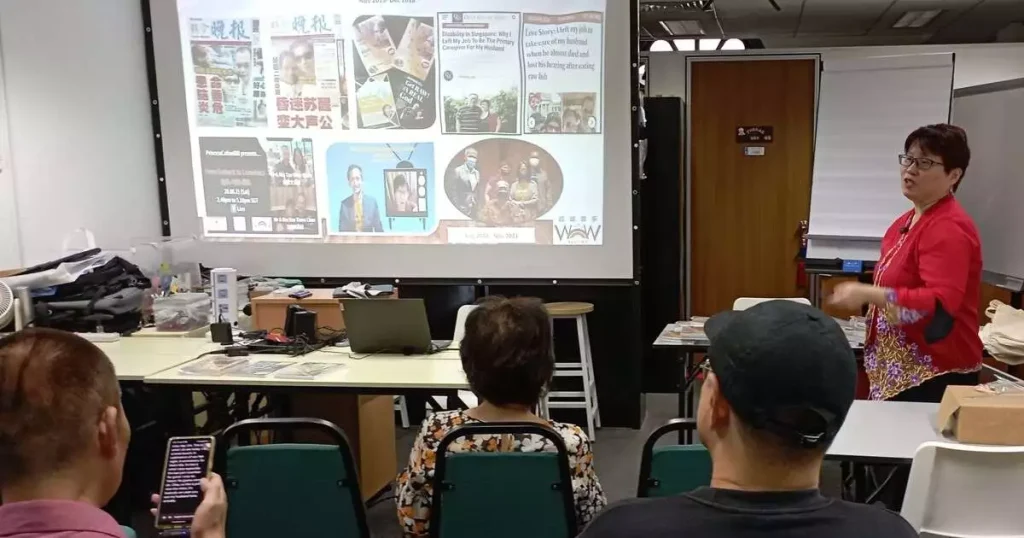

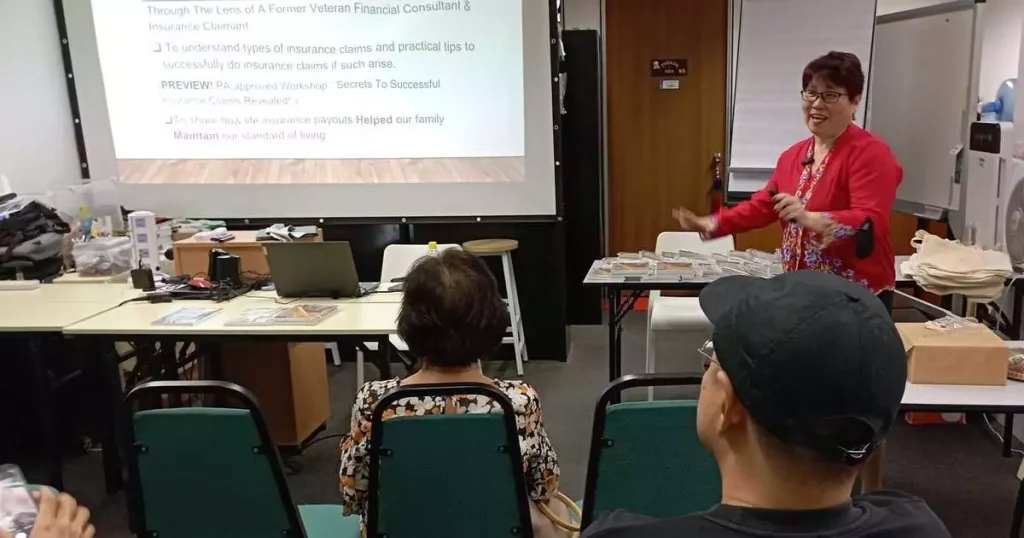

The event provided a comprehensive exploration into the intricacies of navigating the insurance claims process. Attendees gained valuable insights from Cathie Chew, reverse insurance claims specialist, who shared strategies to optimize the chances of a successful insurance claim.

The event is also part of Book Launch for GOOD: Get RAW with a REAL Agent event.

Key Takeaways on Insurance Claims

- Understanding Policy Details:

- Emphasized the importance of thoroughly understanding insurance policies to ensure accurate and timely claims.

- Explained common pitfalls resulting from misconceptions about coverage terms and conditions.

- Prompt Reporting:

- Highlighted the significance of reporting incidents promptly to insurance providers.

- Discussed the impact of delayed reporting on claims processing and potential claim denials.

- Documenting Claims Effectively:

- Provided practical tips for gathering and organizing documentation to support claims.

- Addressed the role of clear, detailed documentation in expediting the claims approval process.

- Effective Communication:

- Explored the art of effective communication with insurance representatives.

- Shared strategies for articulating claims details clearly and professionally.

- Technological Advancements:

- Explored emerging technologies shaping the future of insurance claims.

- Showcased innovations streamlining the claims process for both insurers and policyholders.

Conclusion

The event provided attendees with a holistic understanding of the nuances involved in successfully navigating the insurance claims landscape. By uncovering these secrets, participants gained valuable tools to enhance their ability to secure fair and timely settlements. The event served as a platform for fostering knowledge-sharing within the insurance community.

For enquiries on reverse insurance claims, contact Cathie Chew on Facebook, Instagram or LinkedIn.

About Cathie Chew

Cathie shares unreservedly her journey into the life insurance business that spanned over 2 decades with insurance giant, Prudential Assurance Singapore. Cathie thought that her romance with her “First” love would end after leaving the insurance career to become her husband’s primary care-giver. Her husband was taken ill due raw fish bacteria infection in Nov 2015.

Despite her initial plans to leave the business of life to pursue new interests, Cathie continues to be sought after by former insurance colleagues and former clients in insurance-related matters. Almost single-handedly, Cathie seamlessly and successfully claimed all her husband’s insurance policies. Cathie even blew the minds of the Honeywell’s Human Resource Team when she overturned the decisions of the insurers under the Employee Benefits.

Over 3 consecutive years (2015-2017), Cathie persevered and successfully claimed these policies as the spouse of Honeywell’s former employee! Cathie seeks to give insights into her wealth of expertise as a veteran insurance practitioner. Her uncommon journey into being a claimant in this Raw Fish Saga 2015 was equally thought-provoking. Cathie’s deepest desire is to create a living legacy of sound insurance planning, thus ensuring families are well-weathered financially when crises strike untimely.